Operational risk check

The Operational risk check measures the operational risk of a supplier delivering late or with lower quality within the next 12 months.

The Supplier performance risk score is calculated by comparing the oldest implied rating to the newest implied rating. Moody's implied ratings that are used in the comparison are a way to express the probability of default (PD), to use the language of credit ratings. The higher the risk or score, the higher the probability of the supplier not delivering on time or with the expected quality.

Information used to run this check

To run the check, complete all the required fields in the company entity. The Company number field must be filled out to generate the BvD ID.

Overall results of the check

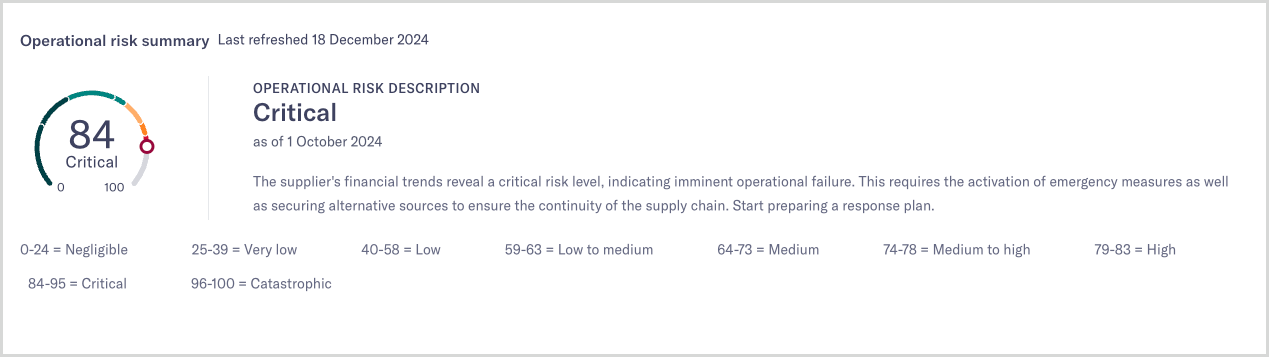

Moody's Orbis generates the Supplier performance risk score that is a risk indicator for the next 12 months. The check lists the information used to run the check and then shows the summary of the results. The score is given on a scale from 0 to 100, where a higher score represents a greater risk of the supplier not delivering on time or with expected quality.

Negligible is a score between 0 to 24.

Very low is a score between 25 to 39.

Low is a score between 40 to 58.

Low to medium is a score between 59 to 63.

Medium is a score between 64 to 73.

Medium to high is a score between 74 to 78.

High is a score between 79 to 83.

Critical is a score between 84 to 95.

Catastrophic is a score between 96 to 100.

To monitor risk, you can set a threshold that triggers an additional task called Log mitigation actions, which is added to the Due diligence tasks list. In this task, you choose one or more actions to mitigate the high risk posed by the supplier.