Assess payment risk check

The Assess payment risk check uses the Moody's Pulse API data provider to deliver insight into credit risk based on a company's payment behaviors.

Information used to run this check

To run the check, complete all the required fields in the company entity. The Company number field must be filled out to generate the BvD ID.

Overall results of the check

The results of the Assess payment risk check include scoring for payment risk and delinquency risk, as well as data on risk history, buying behavior, and payment aging.

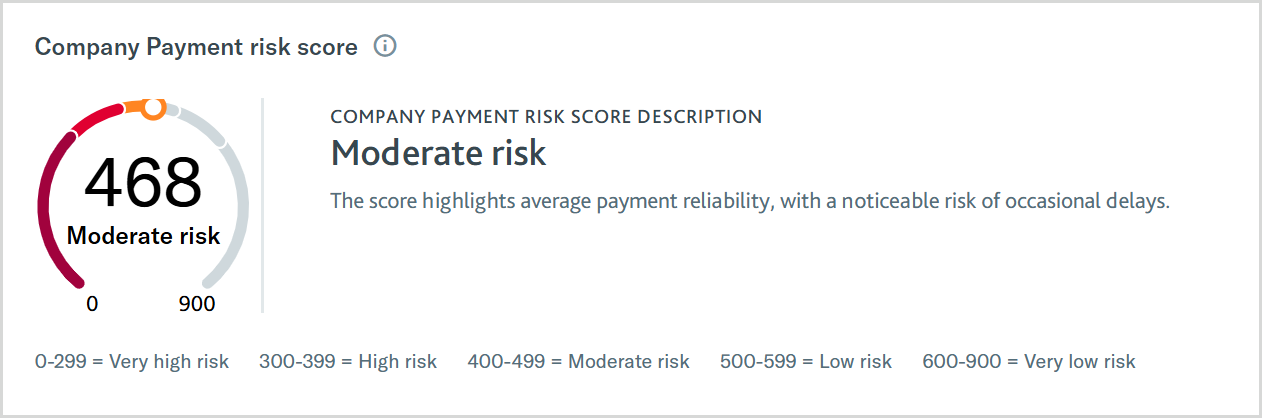

The Assess payment risk check generates a Company payment risk score (CPR) on a scale of 0 to 900, where the higher the rating, the lower the risk. The score describes a company’s payment behavior over the past three to six months.

The CPR score levels are:

Risk level | Color | Score | Description |

|---|---|---|---|

Very low risk | Dark green | 600 - 900 | The payment score indicates highly reliable payments, typically no more than 5 days beyond terms. |

Low risk | Green | 500 - 599 | The payment score indicates dependable payments, typically within 5 to 10 days beyond terms. |

Moderate risk | Orange | 400 - 499 | The payment score indicates moderately reliable payments, typically within 10 to 15 days beyond terms. |

High risk | Red | 300 - 399 | The payment score indicates a higher risk of delayed payments, typically within 15 to 55 days beyond terms. |

Very high risk | Dark red | 0 - 299 | The payment score indicates a very high risk of significantly delayed payments, often more than 55 days beyond terms. |

The Company payment risk history includes charts showing the Company payment risk score and Days beyond terms for the past 12 months. When data is available, you can compare up to two years of payment risk history.

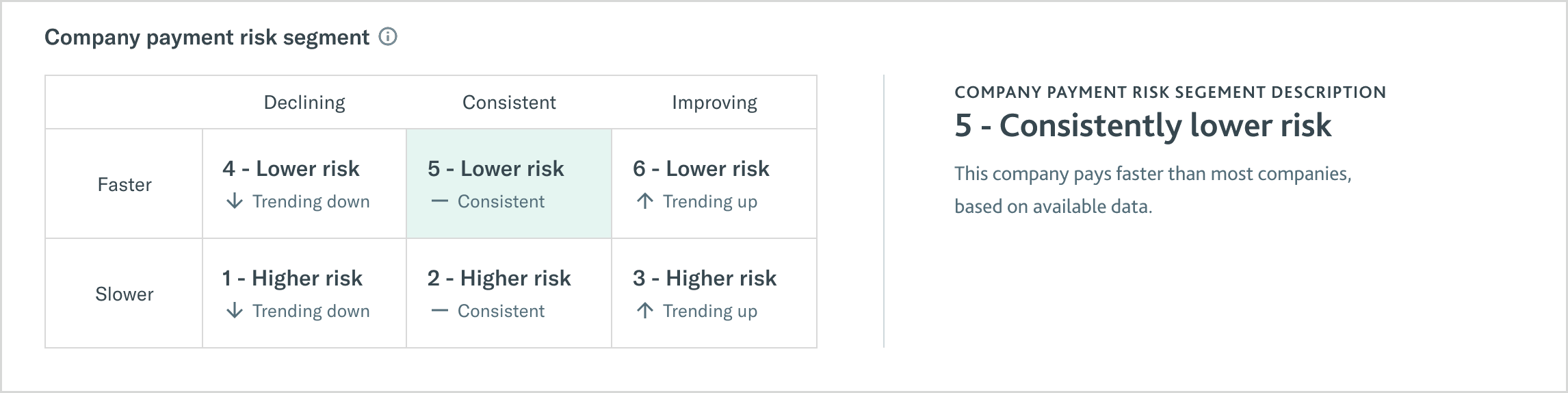

The Company payment risk segment table illustrates how quickly the company is paying vendors and whether the payments are getting faster or slower. The lower the segment number, the slower a company is paying over time.

The payment risk segments are based on available data and include:

Segment | Risk | Payment trend | Description |

|---|---|---|---|

1 | Higher risk | Downward | This company pays significantly slower than most companies. |

2 | Higher risk | Consistent | This company pays somewhat slower than most companies. |

3 | Higher risk | Upward | This company exhibits average payment behavior. |

4 | Lower risk | Downward | This company pays somewhat faster than most companies. |

5 | Lower risk | Consistent | This company pays faster than most companies. |

6 | Lower risk | Upward | This company pays promptly on a consistent basis. |

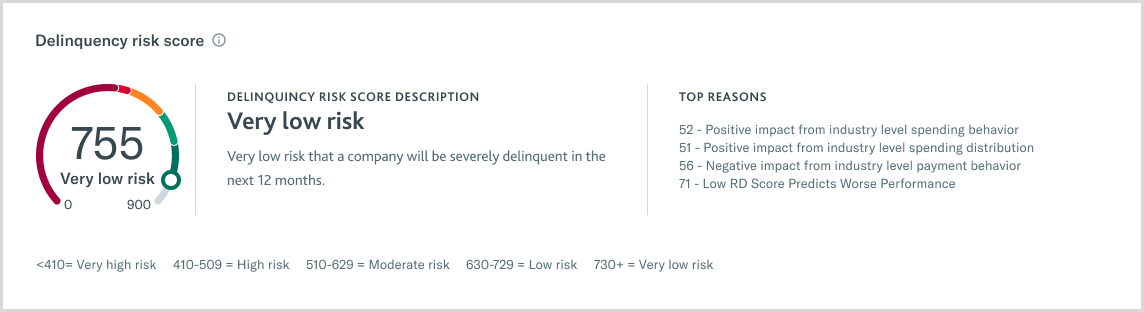

The Delinquency risk score (DR) measures the overall creditworthiness of the company based on available data. The lower the score, the greater the risk that the company will have financial stress in the next 12 months.

The DR score levels are:

Risk level | Color | Score | Description |

|---|---|---|---|

Very low risk | Dark green | 730+ | The delinquency score indicates a very low risk that a company will be severely delinquent in the next 12 months |

Low risk | Green | 630-729 | The delinquency score indicates a low risk that a company will be severely delinquent in the next 12 months. |

Moderate risk | Orange | 510-629 | The delinquency score indicates a moderate risk that a company will be severely delinquent in the next 12 months |

High risk | Red | 410-509 | The delinquency score indicates a high risk that a company will be severely delinquent in the next 12 months. |

Very high risk | Dark red | <410 | The delinquency score indicates a very high risk that a company will be severely delinquent in the next 12 months. |

There are also Delinquency risk history charts that show the company's delinquency risk score and days beyond terms for the past 12 months.

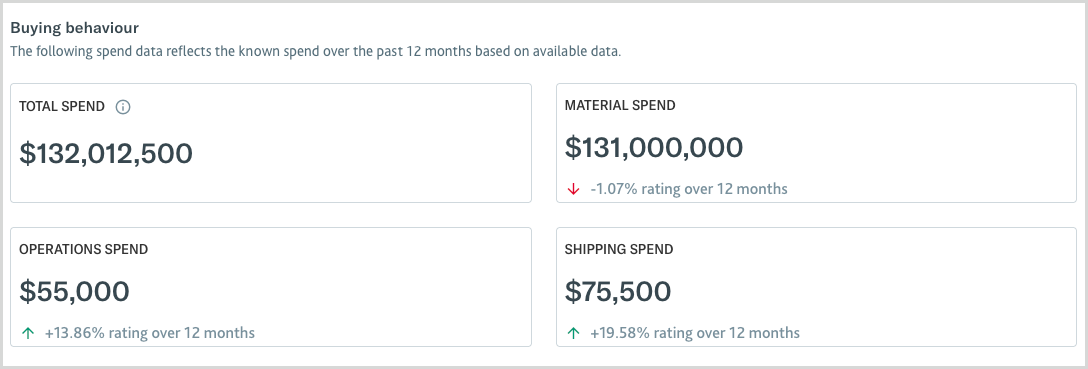

In addition to CPR and DR data, the check returns a summary of the company's buying behavior over the past 12 months.

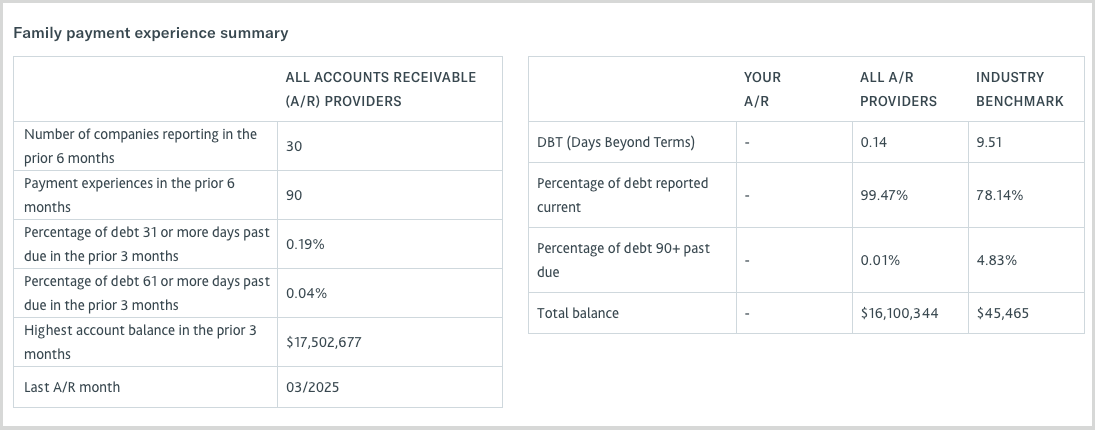

The Assess payment risk check also includes a Family payment experience summary for comparison purposes.

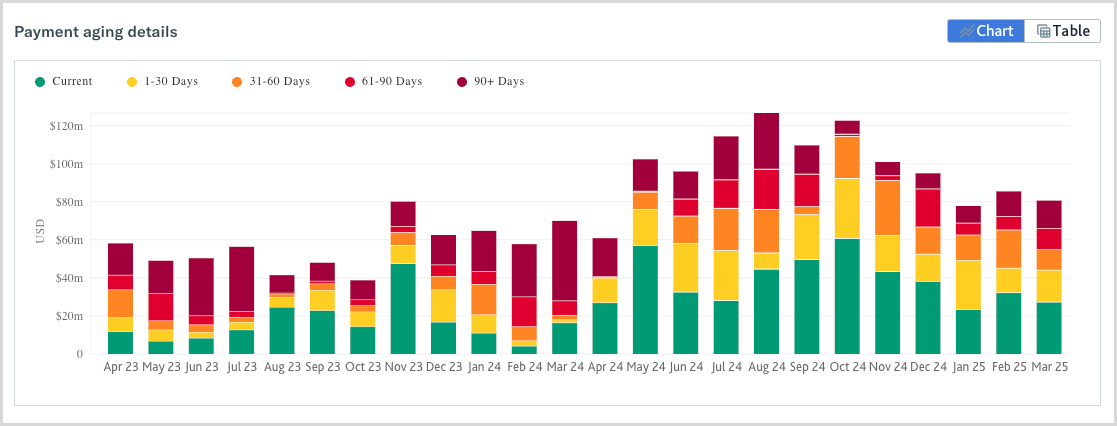

You can review the company's Payment aging details to further determine the risk associated with your buyer.

Select either a or view of payment aging details and toggle between the views as you like.

Assess payment risk check results

These are the possible results of the check. You can select results in the table to view raw data.

Result | Explanation |

|---|---|

Pass | The CPR score and/or DR score meet the provided thresholds. |

Fail | The CPR score and/or DR score do not meet the provided thresholds. |

Error |

|