Geopolitical risk check

The Geopolitical risk check examines events, such as monetary policy instability, social riots, and terrorism, in countries where your critical suppliers and production units are located. These events may alter local companies' ability to produce, deliver products, and provide services.

Information used to run this check

To run the check, complete all the required fields in the company entity. The Company number field must be filled out to generate the BvD ID.

Overall results of the check

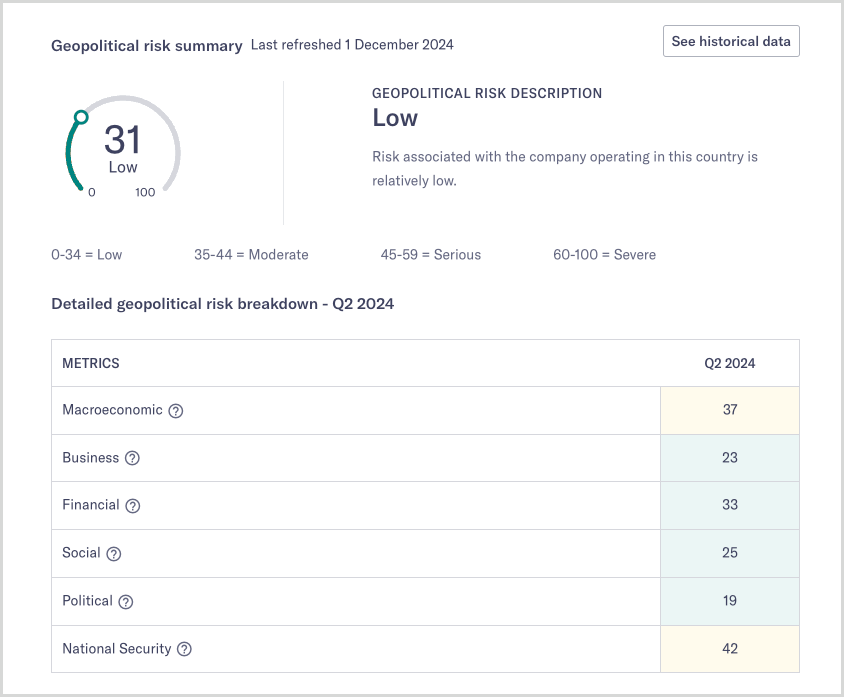

The Company custom check generates a Country risk score by Moody’s, which draws on various economic, social, political, demographic, and survey data and combines these with economic forecasts and subjective assessments of economic policy and institutional risks. The check lists the information used to run the check and then shows the summary of the results. The score is given on a scale from 0 to 100, where a higher score represents more risk.

The scale categories of the risk score are the following:

Low is a score between 0 to 34.

Moderate is a score between 35 to 44.

Serious is a score between 45 to 59.

Severe is a score between 60 to 100.

To monitor risk, you can set a threshold that triggers an additional task called Log mitigation actions, which is added to the Due diligence tasks list. In this task, you choose one or more actions to mitigate the high risk posed by the supplier.

Country risk score by Moody’s is calculated quarterly and consists of a weighted average of numeric scores assigned to six specific risk categories. Each of the six categories has additional individual drivers contributing to the score:

Macroeconomic risk relates to the cyclical nature of the economy and the quality of monetary and fiscal policy.

Business risk reflects operational uncertainty from local conditions that businesses face daily.

Financial risk relates to the possibility of asset and liability valuation shifts due to interest rate and exchange rate shocks.

Social risk relates to the probability of large-scale social upheaval or individual-level risks, such as crime and disease, affecting human resources.

Political risk reflects policy uncertainty or the possibility of significant shifts in political conditions.

Security risk reflects the risk to human life and property from war, terrorism, geopolitical instability, natural disasters, and climate change.

The overall score of the results is the same as Moody’s Analytics country risk indicator, also known as MACRI. To keep the results relevant to the Geopolitical risk check, the overall detailed report has some differences compared to MACRI.

Caution

It is important to note that MIS country rating is not the same as Country risk score by Moody’s, and it is a narrower view without all geopolitical risk calculations present in the Country risk score.

Using the Country risk score has several key advantages, which include:

Coverage: The breadth of data and country coverage sets this score apart from other offerings. Country risk score is based on more than 100 indicators and has a broad country coverage, covering 191 countries.

Comprehensive assessments: The Country risk score uses subjective risk assessments from Moody's economists to complement the objective risk assessments generated by the data. This method depends on the frequency of events in the past rather than their probability in the future.

Uniform comparison: The Country risk score compensates for gaps in data availability by using subjective ratings to impute missing data, allowing Moody's to better track and compare countries over time.